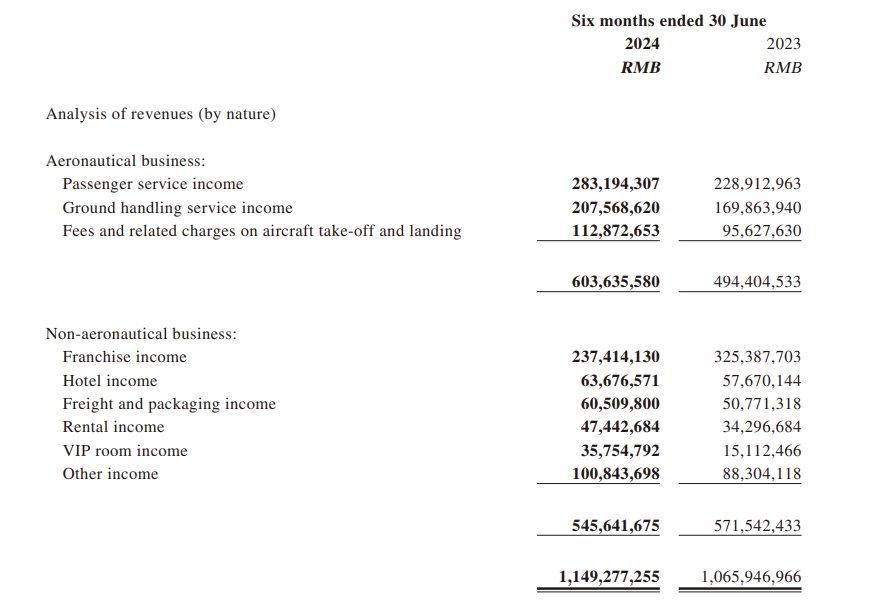

Hainan Meilan International Airport Company posted a -27.03% fall in franchise income (see table below) to RMB237.4 million (US$33.4 million) for its first half ended 30 June. The airport company said the decrease was driven by a fall (unspecified) in duty-free sales and advertising revenue.

The franchise income decline led to a -4.5% year-on-year decrease in first-half non-aeronautical revenue to RMB545.6 million (US$76.6 million).

Passenger numbers increased +20% year-on-year to almost 14.5 million with domestic traffic (key to the offshore duty-free business) up +17%. International passenger volume recovered to 85% of 2019 levels.

Total revenues rose +7.8% to RMB1,149,277,255 (US$161.4 million). The group reported a net loss of RMB248.05 million (US$34.08 million)

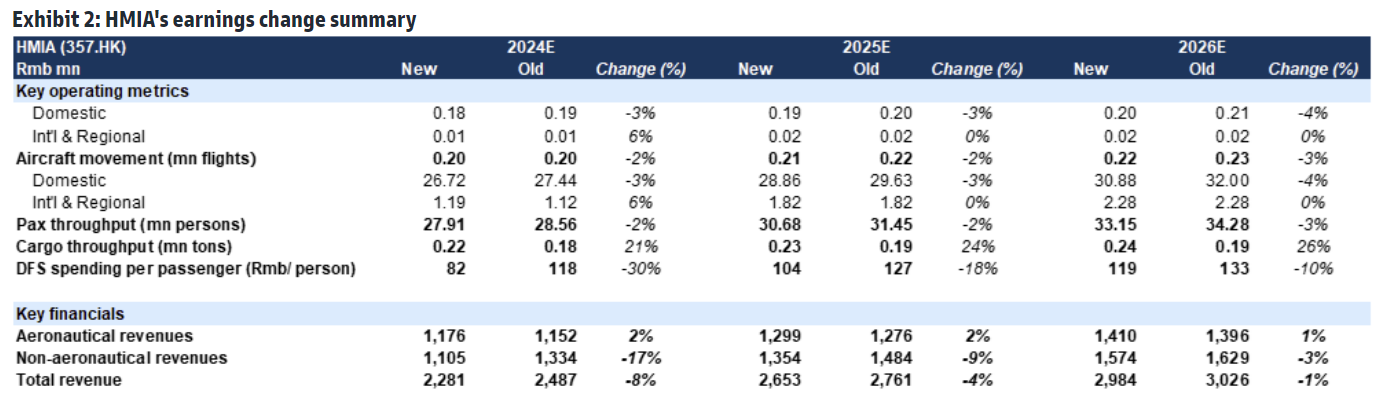

In a note, Goldman Sachs Investment Research commented: “Although the company did not disclose its DFS sales figures, if assuming similar trends in duty-free and duty-on [duty-paid] businesses, this implies duty-free sales per passenger declined by -39% year-on-year to only RMB71 (US$9.97 = 33% of 2021 FY average) similar to the weak DFS spending seen recently in Shanghai International Airport.”

Hainan Meilan Airport Company said that in H1 Hainan offshore duty-free sales in total fell -29.9% year-on-year to approximately RMB18.46 billion (US$2.6 billion), on a -10% fall in shopper numbers to 3.36 million and a -35.9% slump in the number of transactions to 19.8 million.

The airport company attributed the declines to an increase in Chinese outbound travel to Southeast Asia and other countries. This resulted in “serious” dilution of island shopping, it said, adding: “At the same time, changes in tourist consumption habits resulted in a significant decrease in offshore duty-free sales of the whole island.”

First-half visitor numbers to the province rose +10.9% to 51,087,800 while total tourism revenue surged +19.8% to RMB109.739 billion (US$15.4 billion).

Those positive numbers underline the challenges faced by the island’s duty-free industry amid a seemingly sustained consumer trend to non-shopping-related holiday spending.